Southeast Asia: Future Fashion Manufacturing Powerhouse?

China Plus One and the Covid-19 Pandemic

A fabric mill in Guangdong, China. Image courtesy of Bryden Apparel. Apparel manufacturers in Southeast Asia, especially smaller factories without its own fabric production mill, are still highly dependent on China for raw materials, fabrics and trims.

In January 2020, the rapid outbreak of coronavirus in China resulted in an unprecedented shutdown of its manufacturing industry. Factories were ordered to close for 10 days after the week-long Chinese New Year holiday. Yet two weeks after the expected re-opening date, many manufacturers were still not given the green light to resume operations. Chinese provinces also enacted curfews where citizens were confined within their neighbourhoods in order to curb the spread of the disease. Fashion brands such as H&M and Uniqlo, already impacted by the Chinese New Year closure, had to scramble to pivot to alternative manufacturers in countries such as Indonesia, Vietnam and Bangladesh to circumvent the temporary shutdown of the world’s manufacturing powerhouse. Will the impact of Covid-19 on China’s manufacturing and supply chain be the spark to ignite rapid growth for Southeast Asian apparel manufacturers, and for the region to emerge as the next powerhouse for fashion manufacturing?

Garment workers sewing garments in Bryden Apparel's partner factory in Chiang Mai, Thailand. Image courtesy of Bryden Apparel. The apparel manufacturing industry is highly dependent on labour, and it lags behind other industries when it comes to automation as it is difficult for machines to handle and control soft fabrics.

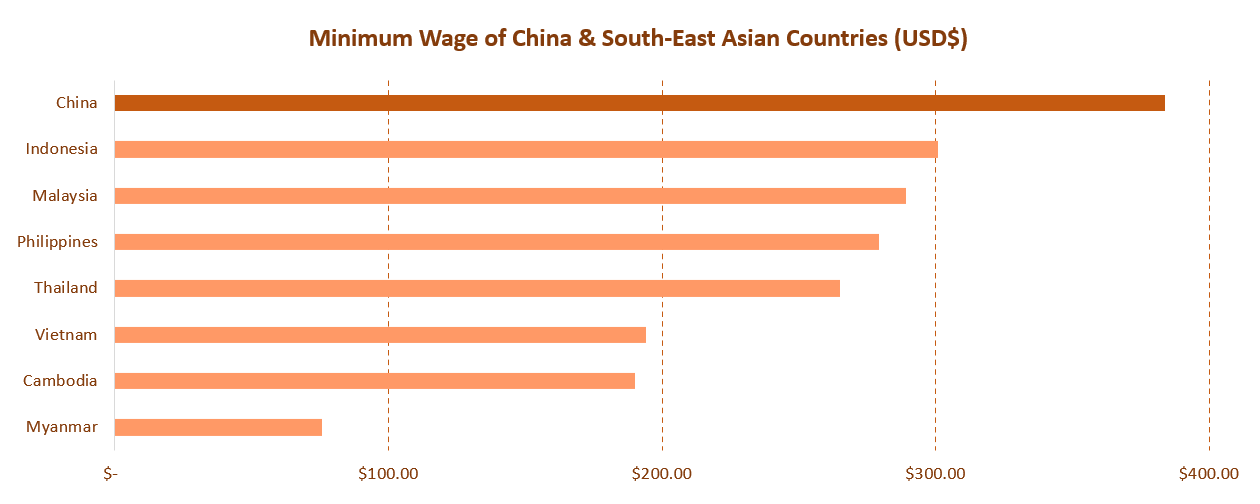

Fashion manufacturing is an extremely labour-intensive industry, and labour costs have a significant impact on the overall production costs. As each step of the fashion manufacturing process involves manual work, any change to labour costs will intrinsically impact the production costs. Despite increasing automation in numerous other industries, in apparel and footwear manufacturing, it is nearly impossible to fully automate some of the production processes such as stitching and ironing due to the lack of dexterity of current machinery. In China, the cost of manufacturing in China has been steadily increasing each year in the past decade as a result of a fast urbanising population and dwindling number of youths interested in factory jobs. Between 2011 and 2021, minimum wage in China has doubled from RMB1280 to RMB2480. The maturing Chinese economy will inevitably result in higher manufacturing costs, and slowly lose its edge in the low-cost, labour-intensive field of fashion manufacturing.

Comparison of minimum wage between China and Southeast Asia countries. Source data: https://tradingeconomics.com/country-list/minimum-wages?continent=asia.

A comparison of the latest minimum wage in 2021 between China and other Southeast Asia countries shows that many of the countries in the Southeast Asia region have a significantly lower minimum wage compared to China. While not all countries are paying minimum wage for their factory workers, it is a good reference point for comparing wage differences between countries. At first glance, lower wages in Southeast Asia certainly seems to make the region a more attractive location for brands looking to lower their cost of manufacturing.

However, labour cost itself is only one of many components that make up a product’s total cost. In apparel and footwear manufacturing, costs of raw materials, transportation and shipping should also be taken into consideration. Some experts have warned that the lower labour cost in developing Southeast Asia countries usually comes with a catch. Frank Vossen, director of Seditex, a company headquartered in Vietnam that provides sourcing and quality-control services to companies developing their production in Vietnam, Cambodia and Myanmar, writes that “China still offers the best price for many products because they are experienced, they have economies of scale and produce nearly everything in their own country. And Chinese factories have more experience in production processes and costing accuracy”. He adds, “Comparatively, Vietnamese factories have lower productivity because many factories started off as state-owned enterprises and still operate very conservatively”. Therefore, while [3] labour wage in Vietnam is lower than China, taking into account total production costs, China does continue to remain more attractive for brands compared to Southeast Asia due to its growing innovation, automation and a more productive and experienced labour force.

Quality-control and packing station in Million Ants Apparel factory in Johor Bahru, Malaysia. Image courtesy of Million Ants Apparel. After the COVID-10 pandemic outbreak, both Bryden Apparel and Million Ants Apparel have received increased enquiries from brands specifically looking to manufacture outside of China.

Rather than shifting the entire manufacturing base from China to other countries, there are brands that instead adopt the China Plus One diversification strategy. This is where brands maintain their China source base while simultaneously developing additional manufacturing sites outside of China. This allows brands to reduce their reliance and dependence on a single manufacturing source, and avoid any disruption or supply bottleneck similar to the factory lockdown experienced in China during the pandemic in 2020.

Bryden Apparel founders Donovan Matthews and Ho Kai Cheng. Image courtesy of Bryden Apparel.

Due to SEA’s close proximity to China, the China Plus One strategy could very likely benefit the region. Companies are able to share resources such as raw and intermediate materials with Chinese factories, and there is also ease in managing Southeast Asian factories that are situated in similar time zones as China. As the pandemic laid bare the need for brands to re-think their production and supply chain strategy beyond China, Southeast Asia is well-positioned to capture this growing market. Ho Kai Cheng, managing director of, a Singapore-based apparel sourcing and production company with factories in China and Thailand, says they received increased enquiries from brands in the United States, United Kingdom and Australia looking to diversify their production outside of China. However, he also acknowledges that these enquiries did not materialise into actual orders for their factory in Thailand. He says, “The unit costs are higher, with limited fabric options and longer production timeline, and this was a big deterrent to the brands.”

A garment worker sewing garments at Million Ants Apparel Factory in Johor Bahru, Malaysia. COVID-19 lockdowns in Southeast Asian countries such as Vietnam and Malaysia have disrupted the region’s manufacturing sectors.

For brands looking to diversify their manufacturing into the Southeast Asia regions, there are more issues these brands can potentially face. Firstly, the Southeast Asia region is made up of disparate, diverse countries – both geographically and culturally – with different languages which can pose a barrier when communicating with local factories. Secondly, these countries are also politically less stable than China, with the April 2021 military coup in Myanmar being a recent example, where major fashion brands such as H&M and Primark suspended operations for four months. Such crises can severely disrupt supply chain and negatively impact the confidence of brands and investors. Thirdly, poor governance and mismanagement can also deter potential brands from shifting towards Southeast Asia region, as can be seen from the waves of COVID-19 outbreaks in countries such as Vietnam and Malaysia which saw lockdowns and factory closures. This instability prompted brands to shift production back again to China, which was able to control waves of outbreaks better than its Southeast Asia counterparts. Additionally, many Southeast Asia countries still lack raw materials for fabric and garment production. Adeline Lim, co-founder of Million Ants Apparel, an apparel factory in Johor Bahur in Malaysia, laments, “Malaysia selection of textile is mostly lacking. For example, trimmings and cotton fabric still need to be imported from China''.

Printer at Million Ants Apparel. Image courtesy of Million Ants Apparel.

This highlights one of Southeast Asia region’s biggest weaknesses: much of its raw and intermediate materials for apparel manufacturing such as fabrics and trims are still imported from China. Shifting manufacturing to Southeast Asia might not fully diversify the brands’ manufacturing sources away from China. Brands looking to reduce their reliance on China for manufacturing might therefore avoid the region, and might instead focus on other emerging manufacturing markets such as India, Bangladesh and Turkey, who, by contrast, are much more self-sufficient in their raw materials and fabrics and trims production.

As brands come to terms with the growing importance of diversifying their source base, there is a window of opportunity for Southeast Asia to capture this burgeoning demand. However, it is an ambitious goal for the region to overtake China as the key source for fashion manufacturing. Moreover, the region will have to compete for its share of the growing pie with other emerging manufacturing regions such as South Asia, South Americas and the Middle East. Southeast Asia will not only have to work on building up its labour productivity, infrastructure and supply-chain. Given that the region is made up of a group of diverse countries, it will have to strengthen its economic integration and fully leverage its economies of scales in order to successfully unlock its potential as a future manufacturing powerhouse.